Over the last two decades, there has been a dramatic shift in assets managed by independent Registered Investment Advisors. Since 2009, AUM at RIAs has jumped from approximately $2T to over $6T today, largely driven by advisors migrating from legacy wirehouses, private banks, and boutiques to independently managed firms.

The core reason behind this shift is outlined below, but first, let’s recognize the entire ecosystem that has evolved around independent advisors and family offices. These tools, service providers, and products have dramatically reduced the barrier to entry for advisors ready to move to an independent affiliation. An entire industry exists to help advisors move and manage assets, from custodians like Fidelity and Schwab to software solutions driving advice and planning like Bento Engine and Asset Map.

The number of providers out there can be overwhelming. Michael Kitces, the Head of Planning Strategy at Buckingham Wealth Partners, and Craig Iskowitz, the Founder and CEO of Ezra Group, produce a Solutions Map that aims to add some order to a crowded sector. Organized to align with the typical advisor workflow, the solutions map provides a detailed directory highlighting tools an advisor may use to manage virtually the entire client lifecycle.

We spoke to Brad Wales from Transition To RIA to ask how advisors sort through the options available as established institutional players all the way down to startups are consistently targeting advisors for new opportunities.

“The good news is there are hundreds of fintech providers supporting the independent space. The bad news is there are hundreds of fintech providers supporting the independent space,” says Wales. “What is a wonderful thing, can also be daunting at first. Advisors should simply focus on what services they want to offer their clients, and then determine the technology solutions to deliver it.”

“I’ve spoken to hundreds of advisors over the years about what is motivating them to consider a move to the independent model. Regardless of how they articulate their reasons, it almost always falls into a desire for more flexibility with their practice and/or better economics.” - Brad Wales

This comment hits home for anyone with a history of working at a legacy institution. Even the most flexible organizations leave advisors wanting more when it comes to the ability to operate their businesses however they’d like and to have a predictable (if not higher) revenue stream that reflects their work in building and maintaining complex relationships. Constantly changing compensation structures meant to drive advisor behavior can be unnecessarily disruptive.

Through independence, advisors can tailor their platform to fit their clients’ needs, and not the other way around.

With the benefits of independence being so clear, and the infrastructure available to support the transition so well developed, why would any top tier advisor choose to affiliate with a legacy firm rather than the route that appears to offer the most flexibility and the highest rate of return?

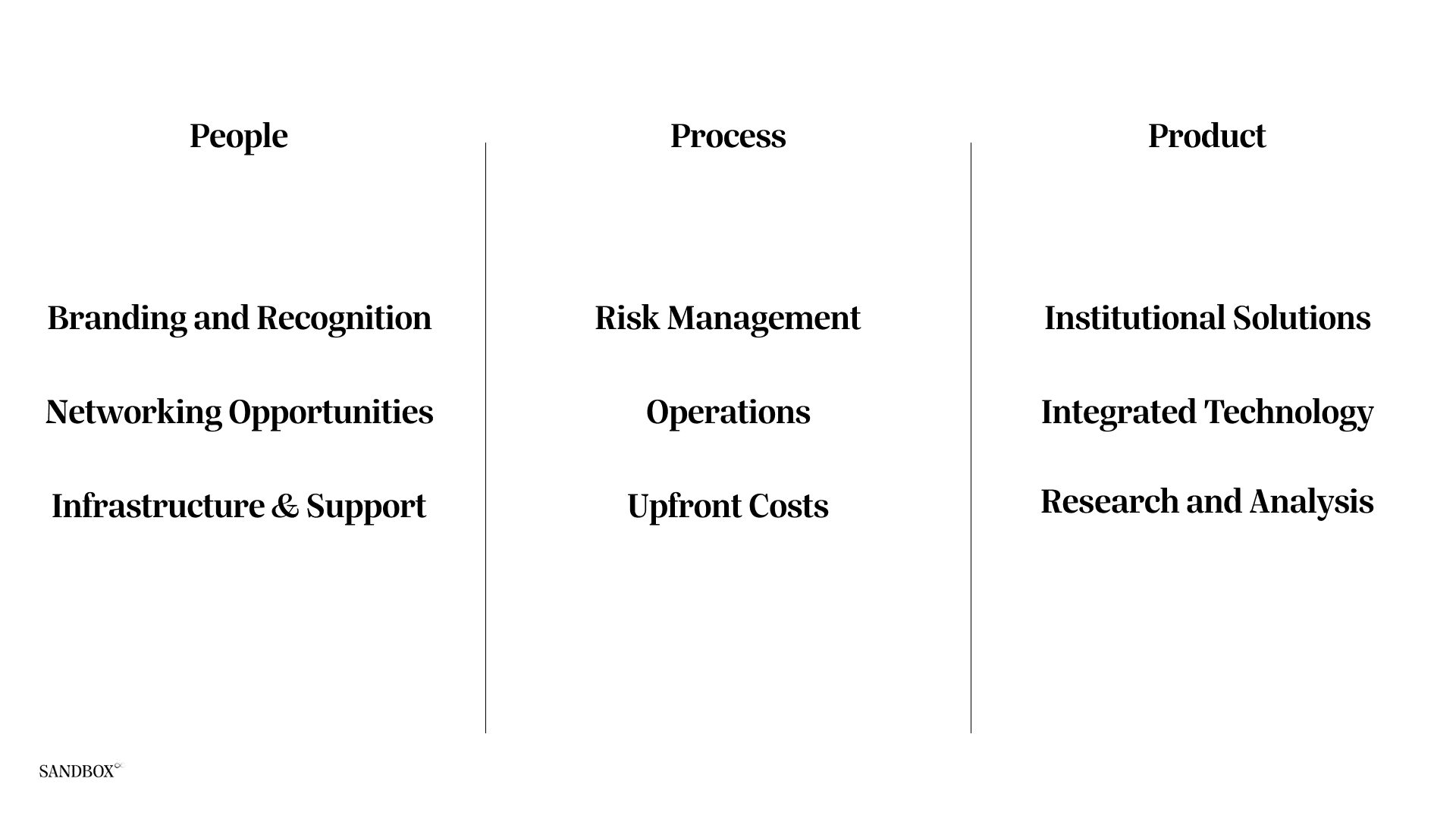

Like so many things in finance, it often boils down to people, process, and product.

You’d expect to hear many of these concerns from less experienced advisors, but for more seasoned advisors who have businesses that would otherwise be portable given the breadth of solutions available, the reason for staying put often has little to do with the complexity of a move.

"Often, it's simply fear of the unknown,” says Wales. “If you have only ever been in a single affiliation model your entire career, that has not prepared you to know how a different model works. With the right resources, such fears can be easily overcome."

Veteran advisors can attest to the importance of banking products in helping build relationships and consolidate assets. Legacy firms have dramatically increased their capabilities across deposit and lending solutions, and incentivized this activity through compensation strategies that reward responsible usage of the firm’s balance sheet.

Providing a mortgage, an art loan, or a loan against a wine collection can be an easy way to learn about a prospect’s passions and pursuits, while also defending against an incumbent who is using those same products to lure clients (and assets) away.

The major custodians understand this. In a recap of the 2022 IMPACT conference, Charles Schwab identified the core risk advisors take when they outsource this activity to a legacy firm:

“When a client brings a lending need to the table, that relationship can be disrupted because the advisor is often forced to introduce an external relationship into the client dynamic. That external lender may not have a compatible philosophy with the advisor.”

This is where Sandbox can help independent advisors deliver. Rather than tying cash management and credit solutions to a custodian or referring this business to an incumbent, our team creates a layer of independence that helps drive clients (and assets) to our partner firms without the risk of losing relationships.

In the end, advisor independence is a personal choice, but it’s one that advisors no longer have to make in fear of being unable to serve their best clients. With tools like Sandbox available to recreate, or perhaps improve on, the solutions available at traditional firms, advisors no longer have to compromise in delivering the best solutions to their clients.

According to Wales, “It is a common misconception that the solution providers supporting the independent space are inferior to what is available with full service platforms. That once rang true, but is no longer the case. It is the opposite now where the breadth of providers available in the independent space now far outweighs the resources of any single traditional firm."