In my own work, I’ve tried to anticipate what’s coming over the horizon, to hasten its arrival, and to apply it to people’s lives in a meaningful way. — Paul G. Allen

Octopus, a 126-meter superyacht, is one of the world’s largest and most well-known vessels built by Lürssen, the luxury shipbuilder. Launched in 2003, she had been loaned out by her original owner, Microsoft’s late co-founder Paul Allen, for various uses spanning scientific research, exploration projects, and rescue missions. The ship can accommodate up to 26 guests in 13 staterooms and 63 crew in 30 cabins. There are several bars, two helicopter pads, a basketball court, and a spa. It is a decidedly tolerable place to spend time with family and friends.

After Mr. Allen’s passing in 2018, Octopus was re-fit, leading to the unfortunate removal of her music studio. The re-fit was performed by Blohm+Voss, a Lürssen subsidiary, eventually selling to Swedish billionaire Roger Samuelsson for a modest €235M.

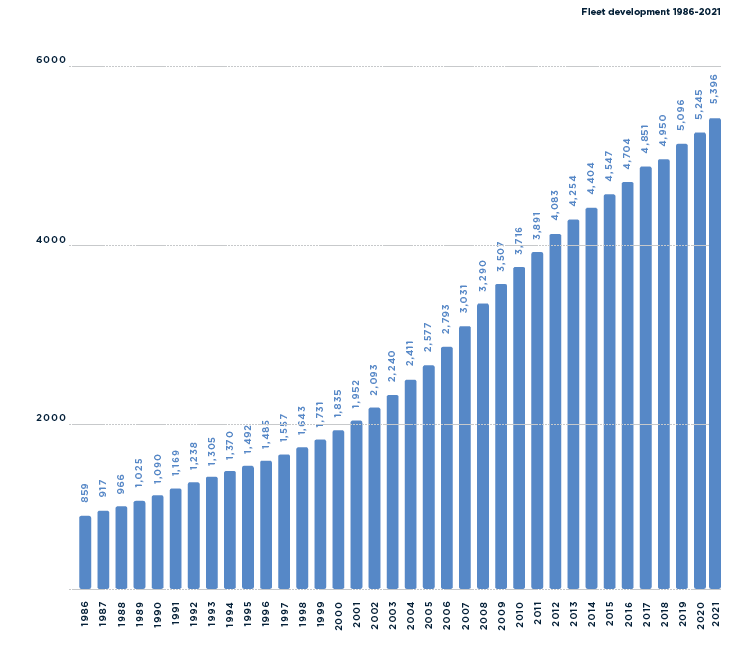

The fraternity of those who own these floating playgrounds is small but growing. The global superyacht fleet went from just 859 ships in 1986 to nearly 5,400 in 2021 — good enough for a CAGR of 5.24% over 35 years. Not bad.

While there are several storylines we could analyze around yachting, we’ll start by focusing on perhaps the most innovative shipbuilder in the industry and its fascinating history spanning nearly 150 years, two world wars, and countless celebrities, tech bros, and oligarchs gracing their decks.

Founded on June 27, 1875, 24-year-old Friedrich Lürssen established the shipbuilding empire in Bremen, Germany, after years as an apprentice with his father, Lüder. The company initially focused on building designer rowboats and saw near immediate success across the country thanks to precise workmanship and lightweight construction. By 1886, in cooperation with Gottlieb Daimler (yes, that Daimler), Lürssen built the world’s first motorboat.

The 6-meter boat was powered by a 1.5 hp engine with an output of 700 RPM. It weighed 60 kilograms (132 pounds) and displaced just 0.462 liters. By 1905, just 30 years after its founding, Lürssen had built DONNERWETTER, a motorboat clocking in top speeds of 35 knots with its 40 hp engine.

While the company continued to focus on motorboats during World War I, Lürssen was, let's say, slightly more involved in World War II. German E-boats (Schnellboot) manufactured by Lürssenwere the fast attack craft of the German Navy during the war. The S-100 class E-boats were 35 meters long and could sustain 43.5 knots, with a top speed of 48 knots. They also manufactured the R1 class of R-boats, which were 26-meter minesweepers capable of going as fast as 20 knots.

While World War II had a material impact on Lürssen’s postwar business, there were also decided advancements in technology during the war that would crossover into the civilian yacht business (the yacht and naval divisions weren’t split until 1988). In 1962, when the third generation of Lürssens took the helm, the company delivered Pegasus II, a 55-meter yacht, to a London-based owner. By 1971, the company had built 71.05 meter Carinthia VI (designed by Jon Bannenberg), which is often described as an icon in 20th-century yacht design.

Mirroring the nearly 7x growth in superyachts over the last 35 years, Lürssen has dramatically expanded its operations in an attempt to keep up with demand without sacrificing speed or quality. Acquisitions have started to pile up with the addition of several shipyards in the last several decades. Kröger Werft (1987), Neue Jadewerft (2004), Norderwerft (2012), Peene Werft (2013), and Blohm+Voss (2016) have all been acquired by the company since 1987.

They’ve continued to innovate alongside their growth, launching the longest yacht in the world in 2015 (AZZAM, 180.65 meters), which also set speed records, topped out at 30 knots, and was built in under three years. In 2016, Lürssen launched the biggest yacht in history (by volume), DILBAR. She weighs in at 15,917 tons, has two helicopter pads, and has a 25-meter pool with 180 cubic meters of water — one of the largest pools ever installed on a yacht. This project was completed in just 52 months.

When Russia invaded Ukraine at the end of February 2022, it created an instant human rights crisis, with untold amounts of damage inflicted on Ukraine and severe loss of life on both sides. Economically, the impact of the conflict has spread far outside of the region, mainly as global energy prices have seen significant volatility. This has had a meaningful effect on inflation and forced central banks to react almost universally by raising interest rates.

The United States and any of its allies reacted to the February invasion by immediately imposing (more) sanctions on Russia, including a number of its citizens. Russian oligarchs were caught up in this wave of sanctions, which included the seizure of several superyachts. By May, the United States, Italy, and France had seized at least seven superyachts valued at just over $1.1B. Unsurprisingly, this has left a mark on yacht sales globally. Russians accounted for up to 13% of the superyachts over 40 meters in the process of being built at the beginning of 2022. It remains to be seen how many of these yachts have had their delivery delayed or canceled because of these sanctions. With the ongoing conflict, any downstream impacts may continue well into 2023, at least until the fighting ends in Ukraine.

As a result of these macro issues, the yachting industry is, like so many industries, looking to solve a gap in its customer base. The solutions range from growing sales geographically by focusing sales efforts in the United States and the Middle East to introducing yachting to a new generation of customers — particularly Millennials and Gen Z (sorry, Gen X, you’re apparently on your own).

Fortunately for Lürssen, they’re no strangers to these short-term disruptions. A case can be made that these turbulent times have driven much of their innovation and growth over the last 150 years. We look forward to seeing what 2023 brings for yachting. If history offers any guidance, Lürssen will be at the forefront of the industry’s evolution.

lurssen.com; Superyacht Times; pt-boat.com; Lenton, H. T. German Warships of the Second World War. London: Macdonald and Jane’s, 1975