When we first read the reports of Justin Bieber selling his music catalog to Hipgnosis Songs Capital for $200M, our initial thought was — “is that all?” Mr. Bieber is only 28, and many recent comparable sales of music catalogs have been for older artists (e.g., Bruce Springsteen, Bob Dylan, and Stevie Nicks). Why wouldn’t he live off the royalty streams, make a few more hits, and sell a mature catalog later in life?

Presuming his objective is to improve his liquidity materially, the prudent decision at this stage is to establish a credit facility secured by his music catalog and pay this down over time using future cash flow. Simple, right? He gets his cash upfront without paying capital gains taxes. If he can squeeze out more income on the catalog than his interest expenses, the positive carry makes the process frictionless. Others have had success with this strategy. For instance, Trey Parker and Matt Stone borrowed $600M against their $1B library in 2021, and plan to use the proceeds to fund a series of private investments.

Another option to consider would be leasing out the rights to the catalog. According to Morgan Stanley, common lease structures offer investors full or partial rights to the catalog for 10 or 30 years. At 28, Mr. Bieber could regain complete control of his catalog at a young age.

Unfortunately for Mr. Bieber, deciding to sell rather than borrow or lease is likely far more complicated. This article will hone in on the likeliest set of factors being evaluated, including interest rates, taxes, inflation, and opportunity costs.

Roylty and Let’s back up a bit. Who is Hipgnosis, and why do they have $200M to spend on a pop star’s music catalog? Well, here’s how they’d describe their mission:

Hipgnosis was created to give the investment community access to extraordinarily successful hit Songs by culturally important artists and to establish Songs as an uncorrelated asset class with attractive returns.

Our ulterior motive is to use the importance of our unparalleled Catalogue and our financial clout as influence to improve the Songwriter’s position in the economic equation.

Our translation: Hipgnosis offers investors access to what was previously inaccessible — cash flows from music royalty streams, which they view as uncorrelated from traditional investments. Uncorrelated returns are good because you won’t necessarily need to worry about a contagion in the public markets taking a toll on your investment. Naturally, they see an upside for the artist by offering the ability to monetize their catalog. After all, you can’t buy a jet with lossless audio.

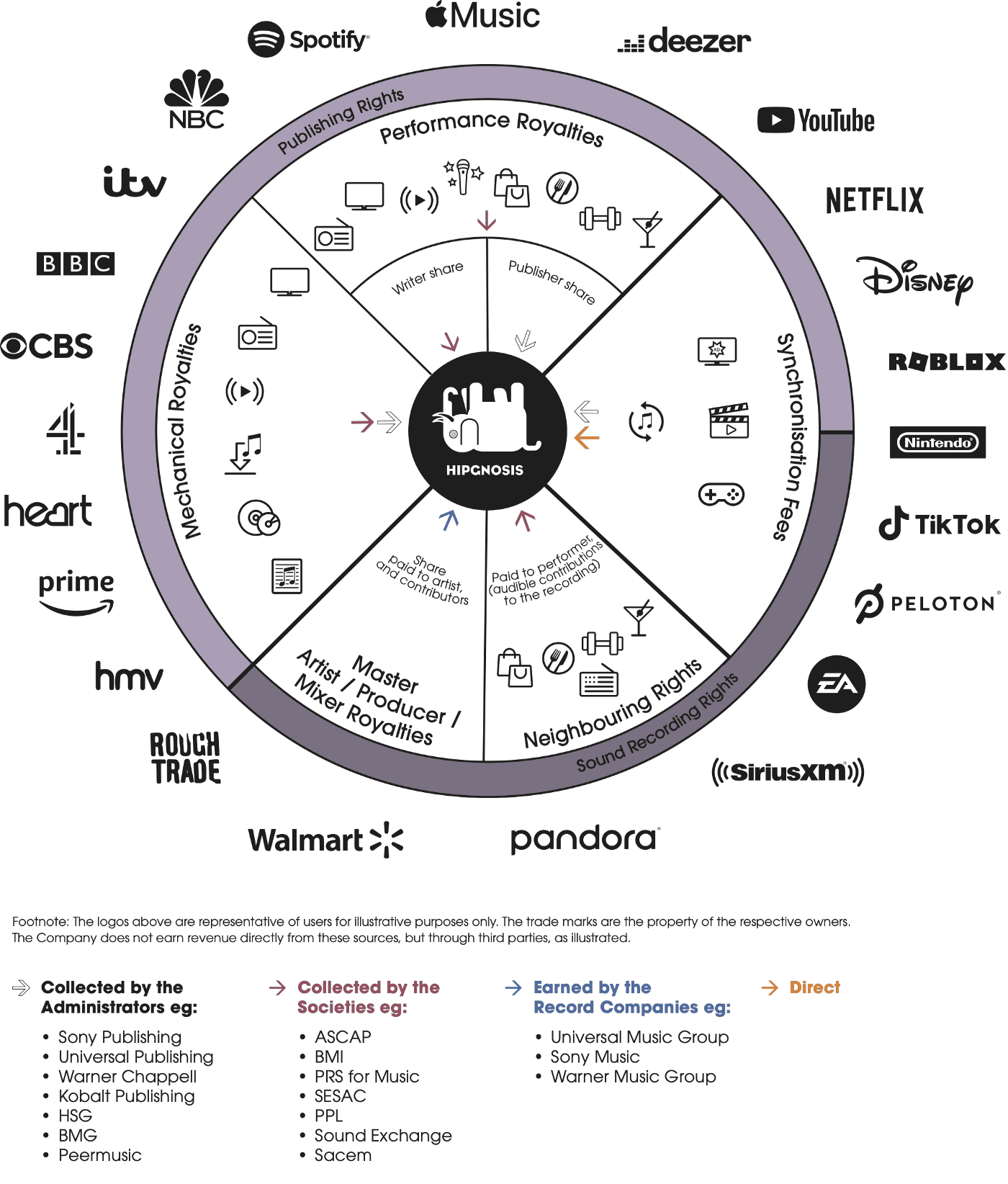

The Hipgnosis model generally focuses on Publishing Rights (also known as Songwriter Rights, where royalties are paid for lyrics and melody). However, they also have investments in Sound Recording Rights, which the various contributors to a recording own.

In late 2021, Blackstone, the world’s largest alternative asset manager, endorsed this strategy by investing $1B into a partnership with Hipgnosis in forming Hipgnosis Songs Capital, the same entity acquiring Mr. Bieber’s music catalog. This privately held vehicle is not just betting on future growth in streaming services; they view an opportunity across social media, video games, and fitness as central to their thesis. At the time, Merck Mercuriadis, the founder of Hipgnosis, told the Wall Street Journal, “In the future we expect to see billions of microtransactions coming at you in real time in a way that is not real different from the way Visa or American Express operates.” If this is the case, certainly there is material growth potential as long as they’ve bet on the right artists.

If drawing a parallel helps, music catalogs are similar to fixed-income portfolios, with the added benefit of being able to drive yield through broad and deep adoption of distribution channels. The more people listen, the more you make. The downside of this comparison for content creators is that music catalogs will become very sensitive to macroeconomic issues, such as rising interest rates, as the market matures. What’s the point of investing in a higher-risk asset if it yields less than a Treasury?

Now for six words we never thought we’d say in public: let’s talk more about Justin Bieber. Why would he sell his catalog instead of borrowing or leasing? It’s impossible to be specific without knowing more about his financials — but we will speculate. Online estimates place his net worth in the neighborhood of $300M. He’s undoubtedly wealthy, but based on this figure alone, we can’t determine how liquid he is, how much cash flow he generates, or how much debt he has. We’ve seen great $100M balance sheets and weak $1B balance sheets. We can only be confident in the factors Mr. Bieber, and his advisors have likely taken into account:

Taxes. Tax treatment is the most significant contributor to any decision around a sale. Royalty payments are taxed as ordinary income, meaning the highest marginal rate would be 37% in the United States. This is compared to the long-term capital gains tax rate of up to 20%. The benefit of a lower capital gains rate is a perk for the music industry — filmmakers, painters, and even video game developers see their sales taxed at ordinary income rates.

Interest Rates. While it’s unclear what Mr. Bieber earns per year in royalties, spiking interest rates can have a material impact on the calculus of whether or not to hold and may very well deter potential borrowers who may no longer have an opportunity to generate a positive carry on loans.

Inflation. While interest rates and taxes can eat into cash flow, inflation can eat into your principal. $200M today will be worth just slightly less tomorrow. A sale makes a lot of sense if there’s an opportunity to reduce risk by diversifying his balance sheet while also gaining the potential to outpace inflation.

Opportunity Costs. Having $200M in locked-up capital will constrain any balance sheet, while $200M in cash offers unlimited opportunities to invest, pay down high-interest debt, or acquire real estate. With fears of a recession at every turn, liquidity can turn short-term distress into long-term appreciation.

Comparable Sales. Another recent seller, Justin Timberlake, sold his catalog to Hipgnosis in May for $100M. While Mr. Timberlake likely doesn’t have the earning power of Mr. Bieber, an opportunity for Mr. Bieber to liquidate at 2x the most recent comparable sale was probably very enticing. Further, the upside appears to be limited in the short term, as deals for older artists were priced anywhere from $100M (Stevie Nicks, 74) to $500M-$600M (Bruce Springsteen, 73). Bob Dylan (79) was priced in the middle of this range at $300M-$400M.

For an artist, selling a music catalog isn’t simply about the money. There’s significant sentimental value stored in these assets. It’s commendable for Mr. Bieber to part with his catalog at such a young age, and doing so will help him maximize his flexibility while, at the same time, we head into uncertain economic times.