"In a more competitive market, Americans will be able to earn higher rates on their savings, pay lower rates on their loans, and more efficiently manage their finances. But the new technologies, and the competition they can fuel, have not yet reached their full potential. Consumers continue to encounter all too familiar obstacles when trying to switch banks or apply for loans." - Rohit Chopra

This fall, the Consumer Finance Protection Bureau will release details of a proposed rule on open banking. We expect the changes, over time, to be as transformational as similar initiatives in the UK and EU, which set off a wave of market-led and regulatory-driven open banking solutions globally. The new rules in the US come on the heels of the successful rollout of FedNow and RTP, which introduced 24/7 instant payment networks to the various ways of moving capital across the country. The days are numbered for primitive practices surrounding wire cutoff times and literal days to settle ACH payments.

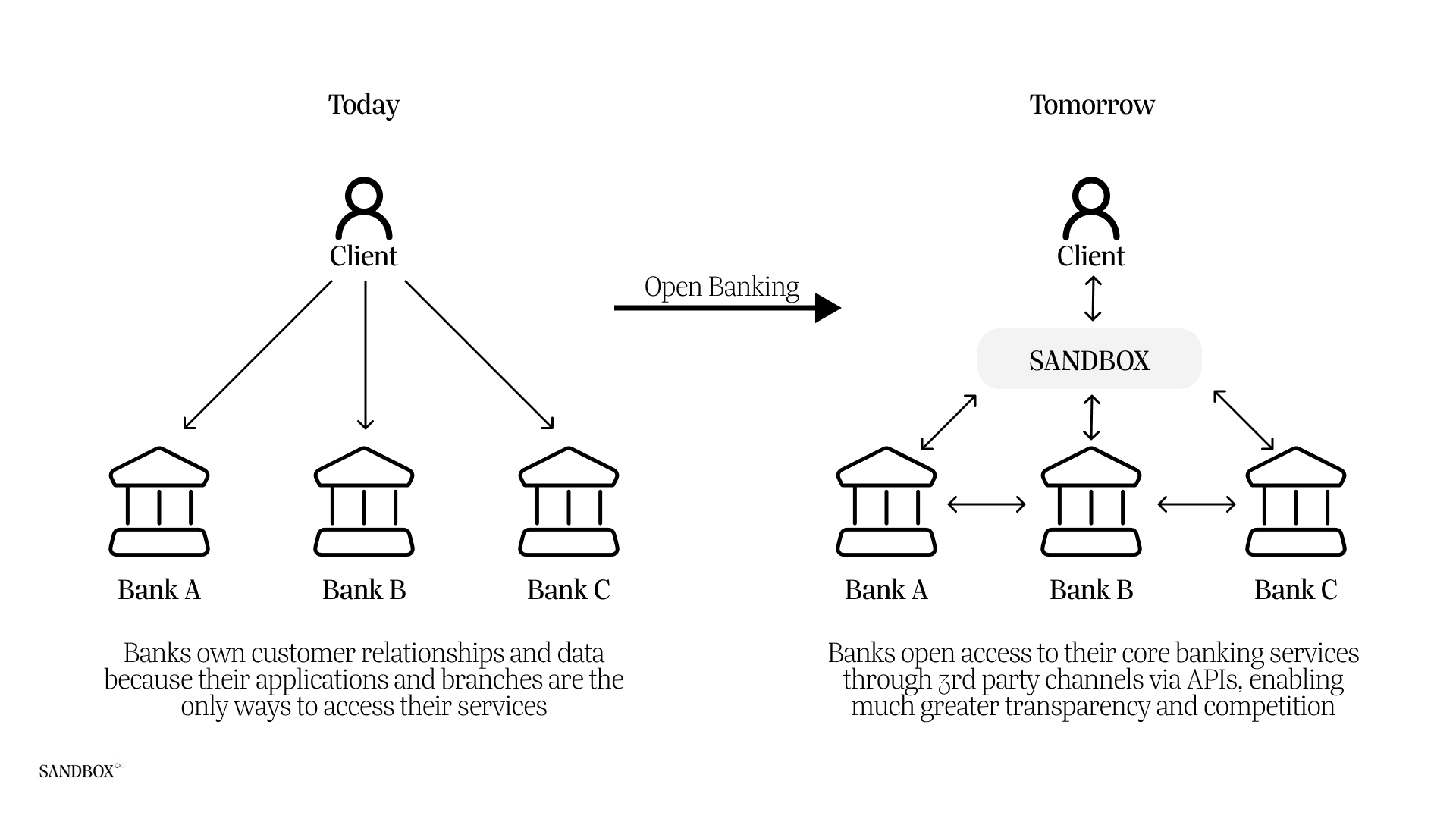

Our team is developing Sandbox to operate at the nexus of these foundational changes to how consumers, families, and businesses manage their data, liquidity, and payments. Our platform, Sandbox Record, is built to ingest data from banks, brokers, custodians, and various illiquid investments. While ensuring that our users maintain complete ownership of their data, we can provide predictive analytics, and an open architecture platform allowing banks and non-bank lenders to compete for business. Our clients win in an environment where we can encourage competition and provide the tools to support informed decisions.

Any explanation of open banking should start with a discussion about open data. As Deloitte puts it, "[u]ntil recently, customer data was zealously kept within the narrow confines of individual organizations." With the recent proliferation of services like Plaid and data aggregation providers ranging in sophistication from Mint to Masttro, consumers are starting to benefit from the unbundling of their data from legacy financial institutions. These new tools and platforms are available because of advances in the use of APIs, or Application Programming Interfaces, which allow for secure communications between two applications. In the case of open banking, this means allowing for trusted applications to access core banking platforms with the account owner's permission.

Separately, bank-sponsored relationships with fintechs have dramatically lowered the barrier to entry for providing banking services. Firms like Mercury, Brex, Rho, and Ramp have exploded in popularity as they've embedded banking and cards into platform solutions for businesses across the spectrum, from startups to enterprise users. For consumers, Chime, Varo, and Current have become popular alternatives to large legacy institutions while offering innovative features like early direct deposit. Internationally, where open banking has seen significant adoption, NuBank, Revolut, Starling Bank, N26, and many more have become household names.

Strangely, the client segment that has arguably benefitted the least from the recent innovation across these products has been wealthy individuals and families. This is particularly odd in the North America, which boasts the largest population of wealthy individuals globally.

Sandbox envisions a future where wealthy individuals and families can take advantage of all the potential open banking offers. Our platform combines data aggregation with embedded banking and lending to give users a sophisticated hub to monitor their balance sheet, cash flow, and overall liquidity position while being able to transact under a single roof.

It's not for a lack of trying. We've seen many attempts to disrupt the relationships legacy institutions have with wealthy clients. Early on, it was digital brokers and, later, robo-advisors. While these platforms have had some success, many could not earn a meaningful amount of wallet share despite having advanced products with cutting-edge features and technology. Today's wave of solutions in neobanking for the wealthy are similarly positioned, with modern, feature-rich products and sleek user interfaces. Still, they have yet to gain the traction or notoriety of the aforementioned business and consumer solutions. The reasoning behind this boils down to two major areas we'll seek to address: trust and differentiation.

First, we work in partnership with investment advisors and we don't offer traditional investments. We are firm believers in advisor independence, and our relationship with a client begins and ends with their investment advisor. We simply don't offer products or services that overlap with our partners, which can often lead to conflicting or even adverserial relationships with both neobanks and legacy institutions. To be more specific, we won't ask clients to move their investments to Sandbox to satisfy a liquidity covenant on a loan, or as bait to earn preferred deposit rates. We rely on building a level of trust with the firms and clients we serve.

Second, building Sandbox wouldn't be worthwhile if we were merely offering deposit products. We are building an open architecture private banking platform, which combines cash management and credit with predictive analytics. Being able to spot trends, manage illiquid assets like fine art or private equity, and to use this data to access capital more efficiently will dramatically save our clients time and increase the surety of execution when pursuing a loan or managing existing liabilities.

A handful of solutions have succeeded by focusing on these two areas, where teams at Vanilla, Wealth, Flourish, and Modern Life, have created lasting partnerships with independent advisors. Ultimately, while the quality of the platform is critically important, developing a differentiated solution in tandem with a client's existing relationship is the way to drive true innovation for wealthy individuals and families.

Our team has decades of experience working with investment advisors and their clients to create custom liquidity solutions. We're taking that experience and developing a tech enabled platform that fully endorses the independent advisor model and addresses many of the pain points we've observed from a client's perspective after originating billions of dollars of loans. Our solutions make it easier for clients to manage their balance sheets, cash flow, liquidity, and illiquid investments, with the end goal of building a system of record that makes the process of accessing capital far more efficient.