Investors are often a great resource because they ask questions an operator might consider to be self-explanatory. Often, these foundational questions help produce the most impactful insights around the relevance of a product or service for a client. After seeing that our offering included deposit accounts, a venture capitalist recently asked why a wealthy client would manage these products through their advisor. A common misconception I had assumed was extinct is still alive - many still believe an advisor's role is limited to managing investments. In reality, the role encompasses holistic wealth planning on both sides of a client's balance sheet, including how they manage liquidity across deposits and credit.

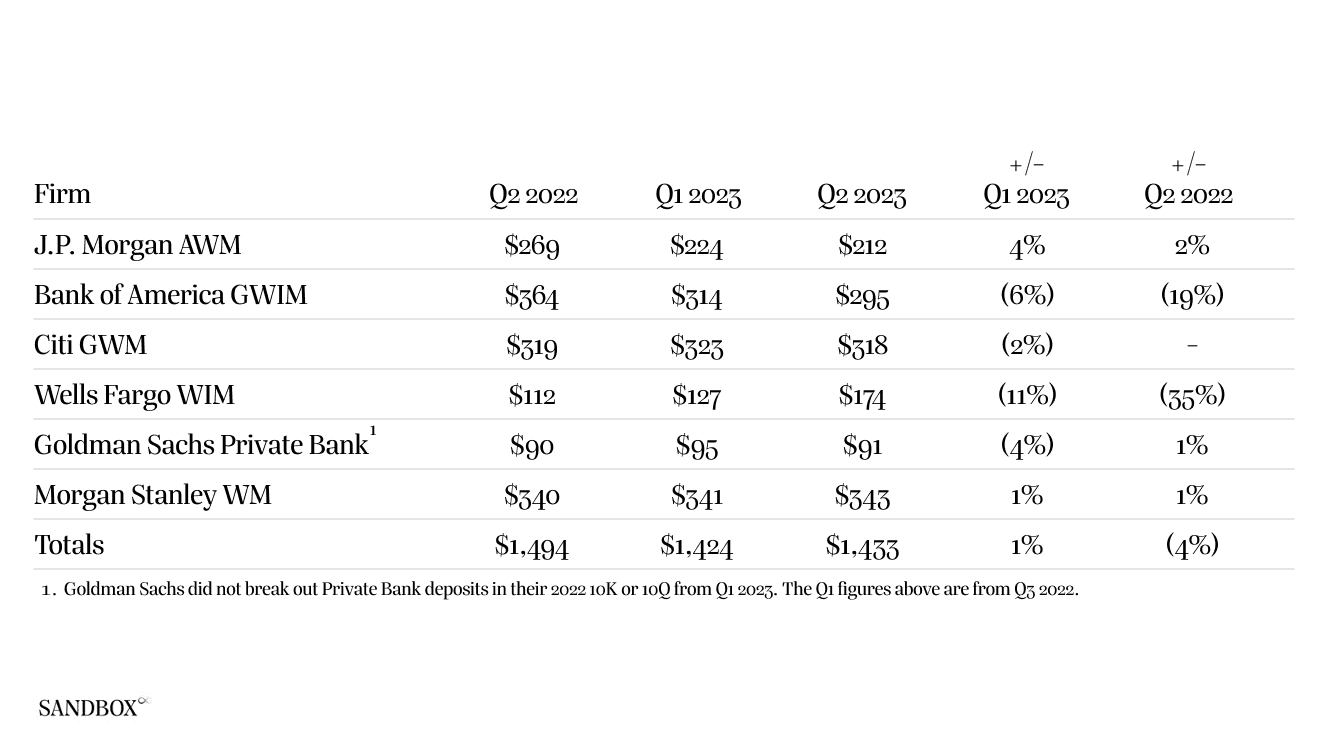

Since the financial crisis in 2008, wealth managers have increased their focus on using deposits and lending to attract wealthy clients. The most notable wealth managers, as outlined in the table below, manage over $1.4T of deposits. Where relevant, these figures exclude deposits managed by consumer arms like Chase or Marcus. On August 15th, Edward Jones, a firm with 19,000 advisors and $1.7T in Assets Under Management, announced its partnership with Citi to offer banking and lending products. Deposits are becoming a core part of a modern wealth manager's business model.

When personalized advice and wealth management is complemented with integrated banking services, clients benefit from a complete set of financial solutions, allowing for more holistic planning opportunities and growth. — Eduardo A. Martinez Campos, Citi

Conceptually, as Citi suggests, a client may benefit as their advisor becomes more involved in their complete financial picture. But what does this mean in practice? While every situation is unique, it could mean understanding the suitability of a private investment or deciding whether a client may need to borrow to meet a tax liability. It could prevent costly tax planning issues like early withdrawals from IRAs and exceeding gift tax limitations. Having an advisor keep a close eye on liquidity can generally assist with ensuring a client is maximizing their yield and is properly allocating their cash across deposits, money markets, and other short-duration instruments. There are many ways a client can derail their long-term investment strategy through the mismanagement of liquidity, and working with their advisor alongside a dedicated banking partner can mitigate those concerns.

Teams like Sandbox must be available to provide adequate support to advisors. Many advisors don't have the time or expertise to manage a client's complex cash management and credit needs, and a team-based approach to delivering these solutions to a client is often preferred. We've built our platform around software to manage liquidity, but our team is experienced in working with wealthy clients to navigate unique situations. We'll happily get on the phone (or a plane) and talk to you. Ultimately, while we partner with our network of banks and capital providers to negotiate pricing and structure, much of the value we offer is in saving time. We assist our partner firms with quickly getting a banking platform up and running while serving their clients by offering a clear picture of their liquidity across various banks and brokers, with the ability to transact on the same platform. In short, we arm our partners with institutional-grade cash management and credit solutions so they can focus their time and energy on ensuring clients meet their long-term objectives.

Independent wealth managers can offer more customized experiences to clients, and firms like Sandbox will further facilitate the move to independence by allowing advisors to provide holistic solutions that work best for their clients. In our fiduciary banking model, we offer advisors and clients the solutions that work best for them, and not simply because we're attempting to meet arbitrary production targets.

We are helping define the future of wealth management through the seamless integration of what's currently a hodgepodge of various vendors and software solutions. Sandbox equips our partners to deliver integrated banking, lending, and analytics without outsourcing each product to separate firms while dramatically improving the client experience.